Maximize Savings: Guide to Utilizing the 5.25% Federal Funds Rate

Maximize your savings by leveraging the current 5.25% Federal Funds Rate through strategies like high-yield savings accounts, certificates of deposit (CDs), and money market accounts, ensuring your financial growth aligns with prevailing economic conditions.

Are you looking to make the most of your savings? With the current Federal Funds Rate at 5.25%, now is an opportune time to explore strategies that can **maximize your savings: a step-by-step guide to utilizing the current 5.25% federal funds rate**. This guide provides actionable steps to help you leverage this rate for optimal financial growth.

Understanding the Federal Funds Rate and Its Impact

The Federal Funds Rate plays a crucial role in shaping the economic landscape. Understanding its mechanics is essential for anyone looking to optimize their savings. This rate influences various aspects of the financial system, ultimately impacting how much you can earn on your savings.

What is the Federal Funds Rate?

The Federal Funds Rate is the target rate that the Federal Reserve (also known as the Fed) wants banks to charge one another for the overnight lending of reserves. It’s a key tool used by the Fed to influence economic activity, manage inflation, and promote full employment.

How Does It Affect Savings Accounts?

When the Federal Funds Rate increases, banks typically raise the interest rates they offer on savings accounts, certificates of deposit (CDs), and other savings products. This means consumers have the potential to earn more interest on their savings. Conversely, when the rate decreases, savings rates tend to follow suit.

Here are some key factors to consider:

- Inflation: The Fed often raises the Federal Funds Rate to combat inflation, making it more attractive for people to save rather than spend.

- Economic Growth: A strong economy can lead to higher rates, as the Fed seeks to prevent overheating.

- Market Expectations: Anticipation of Fed actions can influence market rates even before the Fed makes an official announcement.

In summary, the Federal Funds Rate is a vital economic indicator that directly affects the returns you can achieve on your savings. Staying informed about its movements can help you make better financial decisions.

Exploring High-Yield Savings Accounts

High-yield savings accounts are a powerful tool for maximizing your savings, especially when the Federal Funds Rate is favorable. These accounts typically offer significantly higher interest rates compared to traditional savings accounts, allowing your money to grow faster.

What Makes Them High-Yield?

High-yield savings accounts are often offered by online banks and credit unions, which have lower overhead costs than traditional brick-and-mortar banks. This allows them to offer more competitive interest rates to attract customers.

Benefits of High-Yield Savings Accounts

Besides higher interest rates, these accounts often come with additional benefits such as FDIC insurance, which protects your deposits up to $250,000 per depositor, per insured bank. This provides peace of mind knowing your savings are safe and secure.

Considering a high-yield savings account?

- Competitive Rates: Look for accounts that consistently offer rates above the national average.

- FDIC Insurance: Ensure the account is FDIC-insured to protect your deposits.

- No Hidden Fees: Read the terms and conditions carefully to avoid unexpected charges.

High-yield savings accounts can significantly boost your savings potential, making them an excellent choice for those looking to maximize returns while keeping their funds accessible and secure.

Investing in Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are another effective way to capitalize on the current Federal Funds Rate. CDs are time deposits that offer a fixed interest rate for a specific period, providing a predictable return on your investment.

Understanding CDs

When you purchase a CD, you agree to keep your money deposited for a set term, ranging from a few months to several years. In return, the bank promises to pay you a fixed interest rate throughout the term.

Why Choose CDs?

CDs offer stability and predictable returns, especially valuable in a fluctuating interest rate environment. They are also FDIC-insured, providing security for your principal investment. However, it’s essential to consider the term length and potential penalties for early withdrawal.

Key considerations when investing in CDs:

- Term Length: Choose a term that aligns with your financial goals and liquidity needs.

- Interest Rates: Compare rates from different banks to find the best deal.

- Early Withdrawal Penalties: Understand the penalties for withdrawing your money before the term ends.

In conclusion, CDs can be a strategic addition to your savings portfolio, offering a balance of security and predictable returns, particularly when interest rates are favorable.

Leveraging Money Market Accounts

Money market accounts (MMAs) offer a blend of features from both savings and checking accounts, making them a versatile option for managing your savings. They typically offer higher interest rates than traditional savings accounts and come with some check-writing privileges.

What is a Money Market Account?

Money market accounts are deposit accounts offered by banks and credit unions. They usually require a higher minimum balance than regular savings accounts but offer more competitive interest rates in return.

Benefits of Money Market Accounts

MMAs provide easy access to your funds while still earning a decent interest rate. They often come with debit cards and check-writing capabilities, allowing you to make limited transactions each month. This makes them ideal for those who want liquidity without sacrificing earning potential.

Here are some tips for maximizing your MMA:

- Compare Rates: Shop around for the best interest rates from different banks.

- Maintain Minimum Balance: Ensure you meet the minimum balance requirements to avoid fees.

- Take Advantage of Features: Utilize the check-writing and debit card features for convenient access to your funds.

Considering Treasury Bills and Notes

Treasury bills (T-bills) and notes are debt securities issued by the U.S. Department of the Treasury. They are considered low-risk investments and can be a safe way to earn interest on your savings while supporting the government.

Understanding Treasury Bills and Notes

T-bills are short-term securities with maturities ranging from a few weeks to one year. Treasury notes have longer maturities, typically ranging from two to ten years. Both are sold at a discount and mature at face value, with the difference representing the interest earned.

Why Invest in Treasury Securities?

Treasury securities are backed by the full faith and credit of the U.S. government, making them virtually risk-free. They are also exempt from state and local taxes, which can boost your overall return. However, their yields may be lower compared to other investment options.

Key benefits of Treasury securities:

- Low Risk: Backed by the U.S. government, making them safe investments.

- Tax Advantages: Exempt from state and local taxes.

- Liquidity: Can be easily bought and sold in the secondary market.

Investing in Treasury bills and notes can be a conservative approach to maximizing your savings, particularly for those seeking safety and tax advantages.

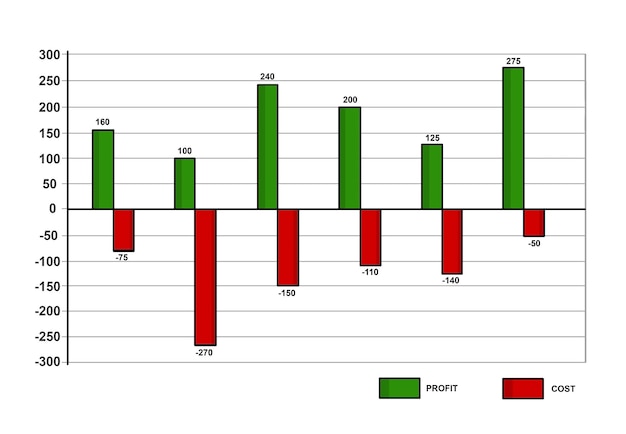

Diversifying Your Savings Portfolio

Diversification is crucial for managing risk and maximizing returns. By spreading your savings across different types of accounts and investments, you can protect yourself from market volatility and take advantage of various growth opportunities.

Why Diversify?

Diversifying your savings portfolio helps to mitigate risk. If one investment underperforms, others can compensate, cushioning the overall impact on your savings. It also allows you to capture different growth opportunities across various asset classes.

Strategies for Diversification

Consider allocating your savings among high-yield savings accounts, CDs, money market accounts, and Treasury securities. The specific allocation should depend on your risk tolerance, financial goals, and time horizon. Regularly review and adjust your portfolio to ensure it aligns with your evolving needs.

Steps to diversify your savings:

- Assess Your Risk Tolerance: Determine how much risk you are comfortable taking.

- Set Financial Goals: Define your short-term and long-term financial objectives.

- Regularly Review and Adjust: Periodically rebalance your portfolio to maintain your desired asset allocation.

| Key Point | Brief Description |

|---|---|

| 💰 High-Yield Savings | Earn higher interest rates compared to traditional savings accounts. |

| 🗓️ Certificates of Deposit (CDs) | Fixed interest rates for a specific term, offering predictable returns. |

| 📊 Money Market Accounts | Combine features of savings and checking accounts with higher interest rates. |

| 🏛️ Treasury Bills/Notes | Low-risk debt securities issued by the U.S. government, exempt from state/local taxes. |

Maximizing your savings involves strategic planning and diversification. By understanding the Federal Funds Rate and exploring various savings options, you can create a robust portfolio that aligns with your financial goals and risk tolerance.

Frequently Asked Questions

▼

The Federal Funds Rate is the target rate that the Federal Reserve wants banks to charge one another for the overnight lending of reserves, influencing economic activity and inflation.

▼

When the Federal Funds Rate increases, banks often raise interest rates on savings accounts, CDs, and other savings products, potentially increasing your earnings.

▼

High-yield savings accounts are savings accounts that offer higher interest rates than traditional savings accounts, often provided by online banks and credit unions.

▼

CDs can be a good investment for those seeking stable, predictable returns with FDIC insurance, especially when interest rates are favorable and terms align with financial goals.

▼

Money market accounts offer a blend of features from both savings and checking accounts, offering higher interest rates than traditional savings accounts and some check-writing privileges.

Conclusion

By understanding and strategically utilizing the current 5.25% Federal Funds Rate through options like high-yield savings accounts, CDs, and money market accounts, you can **maximize your savings: a step-by-step guide to utilizing the current 5.25% federal funds rate** and achieve your financial goals more effectively. Diversifying your portfolio and staying informed are key to long-term financial success.