HSA vs FSA: Choosing the Right Health Savings Account for You

A Health Savings Account (HSA) is a tax-advantaged savings account used for healthcare expenses, while a Flexible Spending Account (FSA) is an employer-sponsored plan that allows pre-tax contributions for eligible medical costs, each with distinct rules on contributions, eligibility, and fund rollover.

Navigating the world of health savings can feel overwhelming. Understanding the differences between a Health Savings Account (HSA) vs. **Flexible Spending Account (FSA)** is crucial for making informed decisions about your healthcare finances. Let’s break down the key features of each, helping you determine which option best suits your individual needs and financial goals.

Understanding Health Savings Accounts (HSAs)

A Health Savings Account (HSA) is a powerful tool for managing healthcare costs, offering unique tax advantages and long-term savings potential. It’s essential to understand the specifics of HSAs to see if they align with your health and financial situation.

What is an HSA?

An HSA is a tax-advantaged savings account specifically designed for individuals with a high-deductible health insurance plan (HDHP). Contributions to an HSA are tax-deductible or pre-tax, the funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This triple tax advantage makes HSAs an attractive option for those looking to save on healthcare costs while also building a nest egg.

Key Features of an HSA

HSAs offer several distinguishing features that set them apart from other savings accounts:

- Eligibility: You must be enrolled in a high-deductible health plan (HDHP) to be eligible for an HSA.

- Contribution Limits: There are annual limits to how much you can contribute, which are set by the IRS and may change each year.

- Tax Advantages: As mentioned, HSAs offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

- Portability: The HSA is yours, and it stays with you even if you change jobs or health plans.

- Investment Options: Many HSAs offer investment options, allowing your savings to grow over time.

In summary, an HSA serves as a valuable savings tool for those with high-deductible health plans, providing tax benefits and flexibility in managing healthcare expenses.

Exploring Flexible Spending Accounts (FSAs)

A Flexible Spending Account (FSA) is another popular option for setting aside pre-tax money for healthcare expenses. While it shares some similarities with an HSA, there are key differences that make it suitable for different situations.

What is an FSA?

An FSA is an employer-sponsored benefit that allows employees to set aside pre-tax money to pay for eligible healthcare expenses. Unlike HSAs, FSAs are not tied to high-deductible health plans, making them accessible to a broader range of individuals.

Types of FSAs

There are several types of FSAs, each designed for specific purposes:

- Healthcare FSA: This is the most common type, used for eligible medical, dental, and vision expenses.

- Dependent Care FSA: This type is used for eligible dependent care expenses, such as childcare or eldercare.

- Limited Purpose FSA: This type is specifically for dental and vision expenses and can be used in conjunction with an HSA.

Key Features of an FSA

FSAs have several important characteristics to consider:

- Employer-Sponsored: FSAs are offered by employers, so you must be employed by a company that offers this benefit to participate.

- Use-It-Or-Lose-It Rule: Generally, FSA funds must be used within the plan year, or you risk forfeiting them. However, some plans may offer a grace period or allow you to carry over a small amount to the next year.

- Contribution Limits: The IRS sets annual contribution limits for FSAs, which may change each year.

- Pre-Tax Contributions: Contributions to an FSA are made on a pre-tax basis, reducing your taxable income.

In a nutshell, FSAs provide a way to save on taxes while paying for healthcare expenses, but it’s important to be mindful of the use-it-or-lose-it rule.

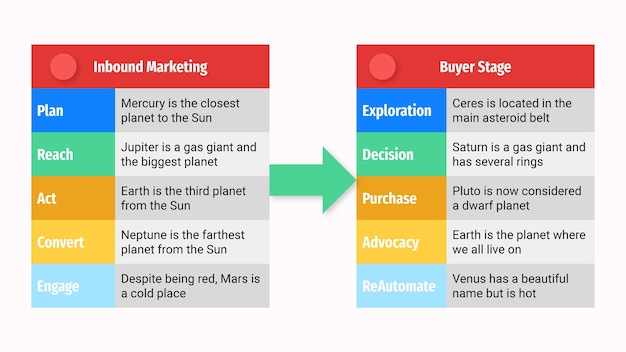

HSA vs. FSA: Key Differences

Understanding the core distinctions between HSAs and FSAs is vital in determining which account aligns better with your personal circumstances and financial objectives. A closer look reveals that while both accounts aim to alleviate the financial strain of healthcare costs, their approaches and suitability differ considerably.

Eligibility and Enrollment

The eligibility criteria for HSAs and FSAs represent one of the most significant differences between the two. To qualify for an HSA, you must be enrolled in a high-deductible health plan (HDHP), not be covered by any other non-HDHP health insurance (with some exceptions), and not be enrolled in Medicare. Unlike HSAs, FSAs don’t require a specific type of health plan. They are typically offered as part of an employer’s benefits package, making them available to a broader range of employees regardless of their health plan.

Contribution Rules and Limits

Both HSAs and FSAs have annual contribution limits set by the IRS, but these limits, and who can contribute, vary. For HSAs, both employers and employees can contribute, and you can even make contributions yourself if your employer doesn’t offer an HSA. FSA contributions are generally made through payroll deductions by employees, though employers can also contribute.

Tax Advantages Compared

Both HSAs and FSAs offer tax advantages, but the nature and extent of these advantages differ. HSAs provide a triple tax advantage: contributions are tax-deductible (or pre-tax if made through payroll deductions), earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. FSAs also offer pre-tax contributions, which reduce your taxable income. Withdrawals for qualified medical expenses are tax-free as well. The biggest tax difference lies in what happens to the funds over time and how they can be used.

Overall, understanding the differences in eligibility, contribution rules, and tax advantages is fundamental to making an informed choice between an HSA and an FSA.

Advantages and Disadvantages of HSAs

HSAs offer several advantages, including tax benefits, portability, and investment options. However, they also have some drawbacks, such as eligibility restrictions and contribution limits. It’s important to weigh these pros and cons before deciding if an HSA is right for you.

Pros of HSAs

- Triple Tax Advantage: Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

- Portability: The HSA is yours, and it stays with you even if you change jobs or health plans.

- Investment Options: Many HSAs offer investment options, allowing your savings to grow over time.

- No Use-It-Or-Lose-It Rule: Unlike FSAs, HSA funds roll over year after year, so you don’t have to worry about forfeiting unused funds.

Cons of HSAs

- Eligibility Restrictions: You must be enrolled in a high-deductible health plan (HDHP) to be eligible for an HSA.

- Contribution Limits: There are annual limits to how much you can contribute, which may not be enough for some individuals.

- Complexity: HSAs can be more complex than FSAs, requiring a better understanding of tax rules and investment options.

In conclusion, HSAs offer significant advantages for those who qualify, particularly in terms of tax savings and long-term investment potential. However, the eligibility restrictions and complexity may make them less appealing to some individuals.

Advantages and Disadvantages of FSAs

FSAs offer simplicity and accessibility, but also come with limitations such as the use-it-or-lose-it rule. Weighing these factors carefully will help determine if an FSA fits your needs.

Pros of FSAs

- Accessibility: FSAs are available to a broader range of individuals, as they are not tied to high-deductible health plans.

- Simplicity: FSAs are generally easier to understand and manage than HSAs.

- Immediate Tax Savings: Contributions are made on a pre-tax basis, reducing your taxable income immediately.

Cons of FSAs

- Use-It-Or-Lose-It Rule: FSA funds must be used within the plan year, or you risk forfeiting them (though some plans offer a grace period or carryover option).

- Limited Portability: FSAs are tied to your employer, so you lose access to the funds if you leave your job.

- No Investment Options: FSAs do not offer investment options, so your savings will not grow over time.

In summary, FSAs provide a straightforward way to save on healthcare expenses, but the use-it-or-lose-it rule and lack of portability can be significant drawbacks for some individuals.

Making the Right Choice for You

Choosing between an HSA and an FSA depends on your individual circumstances, health needs, and financial goals. Consider your eligibility, risk tolerance, and long-term savings strategy when making your decision.

Factors to Consider

When deciding between an HSA and an FSA, consider the following factors:

- Health Plan: Are you enrolled in a high-deductible health plan (HDHP)? If so, an HSA may be a good option.

- Health Needs: Do you have predictable healthcare expenses? An FSA may be suitable if you know you’ll have expenses to cover during the plan year.

- Risk Tolerance: Are you comfortable with investment options and managing your own healthcare savings? An HSA may be a better fit if you’re willing to take on some investment risk.

- Savings Goals: Are you looking to save for long-term healthcare expenses? An HSA may be more advantageous due to its tax benefits and portability.

Scenarios and Recommendations

HSA Scenarios:

- Individuals enrolled in a HDHP seeking tax advantages and long-term savings.

- Those who want to invest their healthcare savings and have the flexibility to use the funds in the future.

FSA Scenarios:

- Individuals who have predictable healthcare expenses and want to save on taxes.

- Those who prefer a simpler savings option without investment risk.

Ultimately, the best choice depends on your unique situation. Consider consulting with a financial advisor to get personalized guidance.

| Key Aspect | Brief Description |

|---|---|

| ⚕️ Eligibility | HSA: Requires High Deductible Health Plan; FSA: Employer-sponsored, broader access. |

| 💰 Tax Benefits | HSA: Triple tax advantage; FSA: Pre-tax contributions, tax-free withdrawals. |

| 🔄 Portability | HSA: Account stays with you; FSA: Tied to employer, limited portability. |

| ⏰ Use of Funds | HSA: Funds roll over; FSA: Use-it-or-lose-it rule (some exceptions). |

Frequently Asked Questions (FAQ)

▼

If you no longer have a high-deductible health plan, you can’t contribute to the HSA, but you can still use the funds for qualified medical expenses. The account remains yours.

▼

No, FSA funds can only be used for qualified medical, dental, and vision expenses. Using them for non-medical expenses will result in tax penalties.

▼

Qualified medical expenses include doctor visits, prescriptions, dental care, vision care, and other healthcare-related costs as defined by the IRS.

▼

In most cases, you cannot have both a general-purpose FSA and an HSA simultaneously. However, a limited-purpose FSA is allowed alongside an HSA.

▼

To enroll in an HSA, you typically open an account with a bank or financial institution. For an FSA, you enroll through your employer’s benefits program during open enrollment.

Conclusion

In conclusion, understanding the nuances of HSAs and FSAs is essential for making informed decisions about your healthcare savings. Both accounts offer valuable tax advantages, but they cater to different needs and circumstances. By carefully considering your eligibility, health needs, and financial goals, you can choose the option that best supports your overall well-being.