Eliminate Credit Card Debt in 12 Months: A Step-by-Step Guide

Debt management strategies offer a structured approach to **eliminating credit card debt in 12 months**, focusing on budgeting, balance transfers, and debt consolidation to regain financial control and achieve a debt-free life.

Feeling overwhelmed by credit card debt? You’re not alone. But what if you could eliminate that debt in just 12 months? This guide provides **debt management strategies**: a step-by-step plan for **eliminating credit card debt in 12 months**, helping you regain control of your finances.

Understanding Your Credit Card Debt

Before diving into strategies, it’s essential to understand the nature of your credit card debt. This involves assessing the total amount owed, interest rates, and minimum payments. Knowing where you stand is the first step toward taking control.

Calculating Your Total Credit Card Debt

Start by listing each credit card and the outstanding balance. Include the interest rate for each card. This will give you a clear picture of your debt burden and the cost of carrying that debt.

Analyzing Interest Rates and Fees

High-interest rates can significantly increase the amount you repay over time. Identify the cards with the highest interest rates, as these should be prioritized in your debt repayment plan. Also, be aware of any annual fees or other charges associated with your cards.

Once you have a clear understanding of your debt, you can begin exploring different debt management strategies. Here are some common options:

- Debt Snowball Method: Focus on paying off the smallest debt first, regardless of the interest rate. This provides quick wins and motivation.

- Debt Avalanche Method: Prioritize paying off the debt with the highest interest rate first. This saves you money in the long run.

- Balance Transfers: Transfer balances from high-interest cards to a card with a lower or 0% introductory rate.

- Debt Consolidation Loan: Obtain a personal loan to pay off multiple credit card debts, ideally at a lower interest rate.

In conclusion, understanding the specifics of your credit card debt – total amount, interest rates, and fees – is crucial for selecting and implementing effective debt management strategies. This knowledge forms the foundation for a successful debt elimination plan.

Creating a Realistic Budget

A budget is a cornerstone of any successful debt management plan. It helps you track your income and expenses, identify areas where you can cut back, and allocate funds toward debt repayment. A realistic budget is key to staying on track and achieving your financial goals.

Tracking Your Income and Expenses

Start by documenting all sources of income. Then, track your expenses for a month to understand where your money is going. Use budgeting apps, spreadsheets, or a notebook to record your spending habits accurately.

Identifying Areas to Cut Back

Once you have a clear picture of your expenses, look for areas where you can reduce spending. Consider cutting back on non-essential items such as dining out, entertainment, and subscriptions. Even small savings can add up over time.

With a well-defined budget, you can allocate specific amounts for debt repayment. Here are some tips to maximize your debt repayment efforts:

- Set Clear Goals: Determine a specific amount you want to pay off each month.

- Automate Payments: Set up automatic payments to ensure you never miss a due date and avoid late fees.

- Use Windfalls Wisely: Allocate any extra income, such as bonuses or tax refunds, toward debt repayment.

Creating and adhering to a realistic budget is crucial for managing debt. It empowers you to make informed financial decisions and allocate resources effectively toward **eliminating credit card debt in 12 months**.

Choosing the Right Debt Management Strategy

Selecting the right debt management strategy depends on your individual financial situation, debt levels, and spending habits. Understanding the pros and cons of each strategy is essential for making an informed decision.

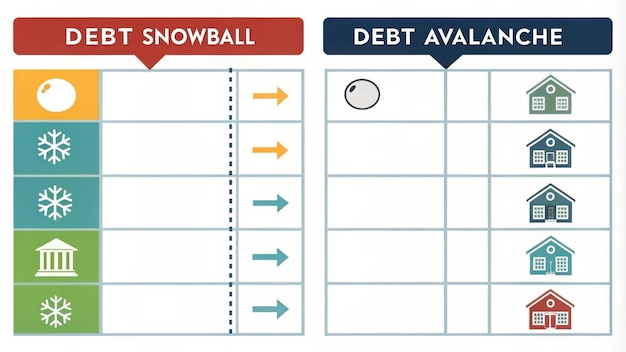

Debt Snowball vs. Debt Avalanche

The debt snowball method focuses on paying off the smallest debt first, providing quick wins and boosting motivation. The debt avalanche method prioritizes paying off the debt with the highest interest rate, saving you money in the long run. Evaluate which approach aligns best with your psychological and financial needs.

Balance Transfers and Debt Consolidation Loans

Balance transfers involve moving balances from high-interest cards to a card with a lower or 0% introductory rate. Debt consolidation loans involve obtaining a personal loan to pay off multiple credit card debts. Assess the interest rates, fees, and terms of each option to determine the most cost-effective solution.

Beyond these strategies, consider the following:

- Negotiate with Creditors: Contact your credit card companies to negotiate lower interest rates or payment plans.

- Credit Counseling: Seek guidance from a non-profit credit counseling agency.

- Debt Management Plan (DMP): Enroll in a DMP, where the agency negotiates with creditors on your behalf and consolidates your payments.

Ultimately, choosing the right debt management strategy requires careful consideration of your individual circumstances. By understanding the strengths and weaknesses of each approach, you can tailor a plan that effectively **elimination credit card debt in 12 months**.

Negotiating with Credit Card Companies

Negotiating with your credit card companies can be a valuable strategy to reduce your debt burden. Many companies are willing to work with you, especially if you’re experiencing financial hardship. Don’t hesitate to reach out and explore your options.

Lowering Interest Rates

One of the most effective negotiation tactics is to request a lower interest rate. Emphasize your payment history and commitment to paying off your debt. A lower interest rate can significantly reduce the amount you pay over time.

Establishing Payment Plans

If you’re struggling to make minimum payments, ask about establishing a payment plan. This may involve lower monthly payments or a temporary suspension of interest charges. Be prepared to provide documentation of your financial situation.

When negotiating with credit card companies, keep these tips in mind:

- Be Polite and Professional: Maintain a respectful tone throughout the conversation.

- Be Prepared: Have your account information and a clear explanation of your situation ready.

- Document Everything: Keep records of all communication, including dates, times, and the names of representatives you spoke with.

Negotiating with credit card companies may not always be successful, but it’s worth trying. Even a small reduction in your interest rate or a more manageable payment plan can make a significant difference in your debt repayment journey.

Increasing Your Income

While cutting expenses is important, increasing your income can significantly accelerate your debt repayment progress. Exploring additional income streams can provide you with more funds to allocate toward **eliminating credit card debt in 12 months**.

Part-Time Jobs and Freelancing

Consider taking on a part-time job or freelancing in your spare time. Many opportunities are available online, such as writing, editing, graphic design, and virtual assistance. Leverage your skills and expertise to earn extra income.

Selling Unwanted Items

Declutter your home and sell unwanted items online or at a local flea market. This is a great way to generate cash quickly and reduce clutter at the same time.

Here are some additional ways to boost your income:

- Rent Out a Spare Room: If you have a spare room, consider renting it out on Airbnb or to a long-term tenant.

- Drive for a Ride-Sharing Service: Drive for Uber or Lyft during peak hours.

- Deliver Food: Work as a food delivery driver for companies like DoorDash or Uber Eats.

Increasing your income can provide a significant boost to your debt repayment efforts. By exploring various income-generating opportunities, you can accelerate your progress toward becoming debt-free and achieving financial freedom.

Staying Motivated and On Track

The journey to **eliminating credit card debt in 12 months** can be challenging, and it’s important to stay motivated and on track. Setting realistic goals, tracking your progress, and celebrating milestones can help you maintain momentum throughout the process.

Setting Realistic Goals

Break down your debt repayment plan into smaller, achievable goals. This will make the overall process less daunting and provide you with a sense of accomplishment along the way.

Tracking Your Progress

Monitor your progress regularly to see how far you’ve come. Use a spreadsheet or budgeting app to track your debt balances, interest rates, and payments. Visualizing your progress can be highly motivating.

Here are some tips for staying motivated:

- Reward Yourself: Celebrate milestones with small, non-financial rewards.

- Find a Support System: Join a debt repayment support group or find an accountability partner.

- Stay Focused on Your “Why”: Remind yourself of the reasons why you want to become debt-free.

Staying motivated is crucial for long-term success in debt management. By setting realistic goals, tracking your progress, and celebrating milestones, you can stay on track and achieve your financial aspirations.

| Key Point | Brief Description |

|---|---|

| 📊 Budgeting | Track income and expenses to identify areas for savings. |

| 📉 Debt Snowball | Pay off smallest debts first for motivation. |

| 💰Income Boost | Freelance or sell items for extra cash. |

| 🤝 Negotiation | Negotiate with lenders for lower rates or payment plans. |

Frequently Asked Questions

The initial step involves calculating your total credit card debt, including balances and interest rates. This provides a clear understanding of your financial situation and helps prioritize repayment efforts.

The Debt Snowball method focuses on paying off the smallest debt first, regardless of the interest rate. This approach can provide quick wins and psychological momentum to keep you motivated.

Balance transfers can be beneficial if you can transfer high-interest balances to a card with a 0% introductory rate. This can significantly reduce your interest payments, but watch out for transfer fees.

If you’re struggling to make payments, contact your credit card company immediately. They may be willing to negotiate a payment plan or offer other assistance to help you avoid late fees and negative credit impacts.

Creating a budget is essential for managing debt. A budget helps you track income and expenses, identify areas where you can cut back, and allocate funds specifically for debt repayment. It is a basic fundamental of debt control.

Conclusion

Implementing these **debt management strategies** requires discipline and commitment, but **eliminating credit card debt in 12 months** is achievable. By understanding your debt, creating a budget, choosing the right **debt management strategies**, and staying motivated, you can regain financial control and secure a brighter future.