Credit Card Debt Payoff: A Step-by-Step Guide for US Residents

Debt management strategies provide a structured approach to paying off credit card debt in the US, involving steps like assessing debt, creating a budget, exploring different payoff methods (like the snowball or avalanche method), and potentially consolidating or transferring balances to lower interest rates.

Feeling overwhelmed by credit card debt? You’re not alone. Many Americans struggle with high-interest debt, but effective debt management strategies can pave the way to financial freedom. This step-by-step guide provides actionable advice for US residents seeking to eliminate credit card debt.

Understanding Your Credit Card Debt

Before embarking on any debt repayment journey, it’s crucial to understand the full extent of your credit card debt. This involves gathering information about your balances, interest rates, and minimum payments.

Gathering Your Credit Card Information

Start by collecting all your credit card statements. If you prefer online access, log in to your accounts and download the statements. Ensure you have the most recent statements to get an accurate picture of your debt.

Calculating Total Debt and Interest Rates

Compile a list of all your credit cards, including the balance owed on each card. Note the Annual Percentage Rate (APR) for each card, as this will significantly impact your repayment strategy.

- List all your credit cards

- Note the balance owed for each card

- Record the APR for each card

- Calculate the total debt

Knowing exactly how much you owe and at what interest rates empowers you to make informed decisions about your debt management strategies. Be thorough in this step to avoid surprises down the line.

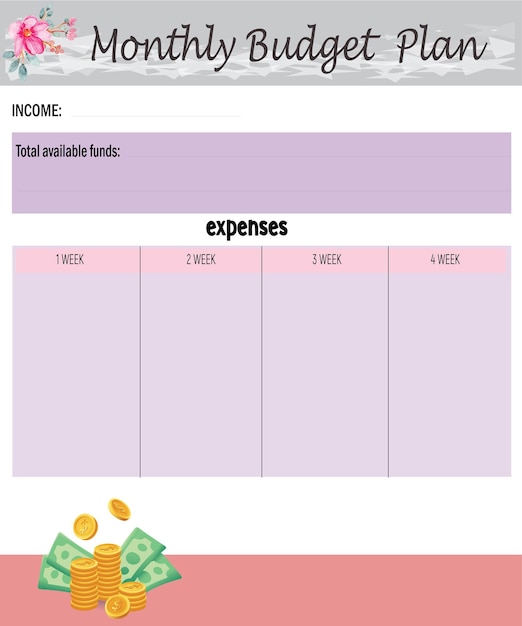

Creating a Realistic Budget

A budget is the foundation of any successful debt repayment plan. It allows you to track your income and expenses, identify areas where you can cut back, and allocate funds towards debt repayment.

Tracking Your Income and Expenses

Start by listing all sources of income, including salary, wages, and any other regular income streams. Next, track your expenses over a month to understand where your money is going. You can use budgeting apps, spreadsheets, or even a notebook.

Identifying Areas to Reduce Spending

Once you’ve tracked your expenses, identify areas where you can reduce spending. Common areas include dining out, entertainment, and discretionary purchases. Even small cuts can add up significantly over time.

Creating a budget is not about deprivation; it’s about making conscious choices about how you allocate your resources. Review your budget regularly and adjust it as needed to stay on track with your debt repayment goals. A well-structured budget is essential for effective debt management strategies.

Debt Repayment Strategies: Snowball vs. Avalanche

Two popular debt repayment strategies are the debt snowball and the debt avalanche. Both methods involve prioritizing debt repayment, but they differ in their approach. Let’s take a closer look at each strategy.

The Debt Snowball Method

The debt snowball method focuses on paying off the smallest debt first, regardless of the interest rate. This provides quick wins and motivates you to continue the repayment process.

The Debt Avalanche Method

The debt avalanche method prioritizes debts with the highest interest rates first. This strategy saves you money in the long run by minimizing the amount of interest paid. However, it may take longer to see initial results.

- Debt Snowball: Focus on smallest balances first for quick wins.

- Debt Avalanche: Prioritize highest interest rates to save money.

- Consider your personality and motivation when choosing a method.

Choosing between the debt snowball and debt avalanche depends on your personality and financial goals. Some people find the quick wins of the debt snowball more motivating, while others prefer the long-term savings of the debt avalanche. Both are valid debt management strategies.

Balance Transfers and Debt Consolidation

Balance transfers and debt consolidation are options that can simplify debt repayment by combining multiple debts into a single loan or credit card with a lower interest rate.

Exploring Balance Transfer Options

A balance transfer involves transferring the balance from a high-interest credit card to a new credit card with a lower interest rate or a promotional 0% APR period. This can save you money on interest charges and accelerate your debt repayment.

Understanding Debt Consolidation Loans

A debt consolidation loan involves taking out a new loan to pay off multiple debts. The new loan ideally has a lower interest rate and a fixed monthly payment, making it easier to manage your debts.

Before pursuing balance transfers or debt consolidation, research your options carefully and compare interest rates, fees, and terms. These debt management strategies can be effective, but it’s essential to understand the potential risks and benefits before making a decision.

Negotiating with Creditors

In some cases, it may be possible to negotiate with your creditors to lower your interest rates or create a more manageable repayment plan. This can provide some relief and make it easier to pay off your debt.

Contacting Credit Card Companies

Reach out to your credit card companies and explain your situation. Be honest and transparent about your financial challenges. You may be surprised at their willingness to work with you.

Exploring Debt Management Plans

Some non-profit credit counseling agencies offer debt management plans (DMPs). These plans involve working with a counselor to create a budget and negotiate with creditors on your behalf.

Negotiating with creditors requires patience and persistence. Not all creditors will be willing to negotiate, but it’s worth exploring this option as part of your debt management strategies. Be wary of companies that promise unrealistic results or charge excessive fees.

Avoiding Future Debt

Once you’ve successfully paid off your credit card debt, it’s crucial to take steps to avoid accumulating debt in the future. This involves developing healthy financial habits and making conscious spending decisions.

Building an Emergency Fund

An emergency fund can help you cover unexpected expenses without resorting to credit cards. Aim to save at least three to six months’ worth of living expenses in an easily accessible account.

Living Below Your Means

Living below your means involves spending less than you earn. This allows you to save money, pay off debt, and build a secure financial future.

- Create a budget

- Track your spending

- Set financial goals

- Avoid impulse purchases

Avoiding future debt is just as important as paying off existing debt. By developing healthy financial habits, you can maintain your financial freedom and avoid the stress of credit card debt. These debt management strategies are long-term investments in your financial well-being.

| Key Point | Brief Description |

|---|---|

| 📊 Budgeting | Track income/expenses to allocate funds for debt repayment. |

| ⚔️ Snowball/Avalanche | Choose method based on preference (smallest balance or highest interest). |

| 🤝 Negotiation | Contact creditors for lower rates or repayment plans. |

| 💰 Emergency Fund | Build savings to avoid future debt from unexpected expenses. |

What are the first steps in managing credit card debt?

▼

Start by assessing all your credit card debts, including balances, interest rates, and minimum payments. Creating a detailed list will help prioritize your repayment efforts.

How does the debt snowball method work?

▼

The debt snowball method involves paying off the smallest debt first, regardless of its interest rate. Once that debt is paid off, you roll that payment amount into the next smallest debt.

What is the debt avalanche method?

▼

The debt avalanche method prioritizes debts with the highest interest rates. By focusing on high-interest debts, you’ll save more money over time and reduce the overall burden of your debt.

Is debt consolidation a good option?

▼