Financial Planning for Divorce: Secure Your Future

Financial planning for divorce involves assessing assets, debts, and future income to make informed decisions about property division, alimony, and child support, ensuring financial stability post-divorce.

Divorce is undeniably a challenging life event, and amidst the emotional turmoil, it’s easy to overlook the critical aspect of financial planning for divorce. A well-structured financial plan can provide clarity, minimize stress, and pave the way for a secure future, allowing you to navigate this transition with confidence.

Understanding the Importance of Financial Planning During Divorce

Divorce not only brings about emotional changes but also significantly impacts your financial situation. It’s crucial to understand the importance of meticulous financial planning to protect your assets, determine future income needs, and secure a stable future.

Effective financial planning during divorce involves a comprehensive assessment of your current financial state and projecting your future needs. This includes understanding your assets, debts, income, and expenses, and how these will change post-divorce.

Why Financial Planning is Essential

Financial planning ensures that you are fully aware of your financial situation and can make informed decisions that protect your interests. Here are some key reasons why it’s essential:

- Provides Clarity: Helps you understand your financial situation and future needs.

- Protects Assets: Ensures fair division of assets and minimizes financial losses.

- Reduces Stress: Offers a roadmap for financial stability, reducing anxiety during a difficult time.

- Secures Future: Helps you plan for long-term financial independence and security.

By addressing these key aspects, financial planning becomes an indispensable part of the divorce process, providing a solid foundation for your future.

Assessing Your Current Financial Situation

Before making any decisions, it’s vital to thoroughly assess your current financial situation. This involves gathering all relevant financial documents and understanding your assets, debts, income, and expenses.

This assessment will serve as the basis for all financial decisions made during the divorce process. It provides a clear picture of your financial health and helps identify potential areas of concern.

Gathering Financial Documents

Collecting all necessary financial documents is the first step in assessing your financial situation. These documents provide a complete overview of your financial history and current standing.

- Tax Returns: Provide insights into your income and deductions over the past several years.

- Bank Statements: Show your account balances and transaction history.

- Investment Statements: Detail your investment holdings and their current value.

- Loan Documents: Outline your debts, interest rates, and payment schedules.

Having these documents readily available will streamline the process and prevent delays during negotiations or court proceedings.

Understanding your financial landscape is essential for making informed decisions throughout the divorce process. By gathering and analyzing these documents, you can develop a realistic financial plan that protects your interests and sets you up for future success.

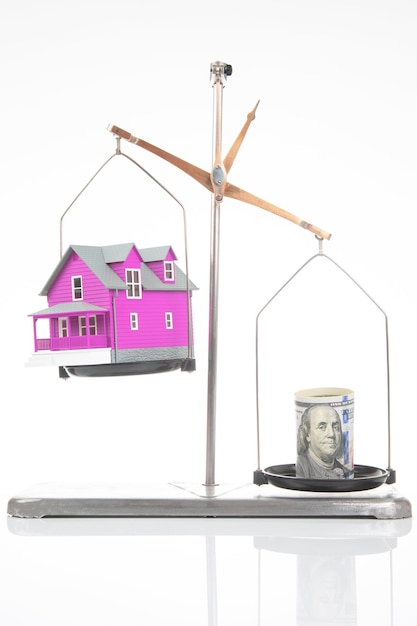

Understanding Asset Division

One of the most significant financial aspects of divorce is understanding how assets will be divided. State laws vary, but most follow either community property or equitable distribution principles.

Navigating this aspect requires a clear understanding of the different types of assets and how they are treated under the applicable state laws. This knowledge ensures a fair and equitable outcome.

Community Property vs. Equitable Distribution

The two primary methods for dividing assets in a divorce are community property and equitable distribution. Knowing which method applies in your state is crucial.

- Community Property: Assets acquired during the marriage are owned equally by both spouses and are divided 50/50.

- Equitable Distribution: Assets are divided fairly, but not necessarily equally, taking into account various factors such as each spouse’s contribution to the marriage.

Understanding these principles is foundational to protecting your financial interests during the divorce process.

Types of Assets to Consider

Identifying and valuing all assets is a critical step in the division process. Here are some common types of assets that need to be considered:

- Real Estate: Homes, land, and other properties.

- Retirement Accounts: 401(k)s, IRAs, and pensions.

- Investments: Stocks, bonds, mutual funds, and other investment accounts.

- Personal Property: Vehicles, furniture, jewelry, and other valuable items.

Proper valuation and understanding of these assets will ensure a fair and equitable division.

Understanding asset division is vital in securing your financial future post-divorce. By being informed about the laws in your state and the types of assets involved, you can advocate for a fair outcome that meets your financial needs.

Navigating Alimony and Spousal Support

Alimony, also known as spousal support, is a payment made by one spouse to the other after a divorce. The purpose of alimony is to help the lower-earning spouse maintain a reasonable standard of living.

Understanding the factors that determine alimony eligibility and the different types of alimony is crucial in ensuring a fair outcome. This involves assessing financial needs and future earning potential.

Factors Influencing Alimony Awards

Several factors are considered when determining whether to award alimony and the amount and duration of the payments. These include:

- Length of the Marriage: Longer marriages often result in longer alimony periods.

- Earning Capacity: The court considers each spouse’s ability to earn income.

- Standard of Living During Marriage: The goal is to maintain a similar standard of living for both spouses, if possible.

- Contributions to the Marriage: Contributions as a homemaker or caretaker are also considered.

These factors are carefully weighed to determine a fair and reasonable alimony arrangement.

Navigating alimony and spousal support requires a comprehensive understanding of the relevant laws and financial factors. By being well-informed and prepared, you can advocate for a fair outcome that supports your financial stability post-divorce.

Planning for Child Support

If children are involved, child support is a critical financial consideration in divorce. Child support is intended to cover the costs of raising the children, including housing, food, clothing, and education.

Understanding how child support is calculated and ensuring that the support adequately meets the children’s needs is essential. This involves considering both parents’ income and the specific needs of the children.

H3>How Child Support Is Calculated

Child support calculations vary by state but typically consider several factors:

- Parents’ Income: The income of both parents is a primary factor in determining the support amount.

- Number of Children: The more children, the higher the support obligation.

- Custody Arrangement: The amount of time each parent spends with the children can impact the support amount.

- Additional Expenses: Healthcare costs, education expenses, and extracurricular activities may also be factored in.

Understanding how these factors are applied in your state is crucial to ensuring an accurate and fair child support order.

Planning for child support is a vital part of the divorce process when children are involved. By understanding how support is calculated and advocating for your children’s needs, you can ensure their well-being and financial security.

Securing Your Financial Future Post-Divorce

After the divorce is finalized, it’s important to take steps to secure your financial future. This involves creating a post-divorce budget, managing your investments, and planning for retirement.

Taking proactive steps to manage your finances and plan for the future will ensure long-term financial stability and independence. This includes setting financial goals and making informed decisions.

Creating a Post-Divorce Budget

Establishing a budget is essential for managing your finances after divorce. This involves tracking your income and expenses and identifying areas where you can save money.

- Track Income and Expenses: Monitor your monthly income and expenses to understand where your money is going.

- Identify Savings Opportunities: Look for ways to reduce expenses and save money.

- Set Financial Goals: Establish clear financial goals, such as paying off debt or saving for retirement.

A well-structured budget provides a roadmap for your financial future and helps you achieve your goals.

Managing Investments and Planning for Retirement

Managing your investments and planning for retirement are crucial for long-term financial security. This involves reviewing your investment portfolio and making adjustments as needed.

- Diversify Investments: Spread your investments across different asset classes to reduce risk.

- Review Retirement Plans: Evaluate your retirement savings and make adjustments to ensure you are on track.

- Seek Professional Advice: Consult with a financial advisor to get personalized guidance.

By taking these steps, you can build a strong financial foundation for the future.

Conclusion

Financial planning for divorce is a critical process that requires careful consideration and proactive management. By understanding the key aspects, such as asset division, alimony, child support, and future planning, you can navigate the process with confidence and secure your financial future. Seeking professional guidance from financial advisors and legal experts can provide invaluable support and ensure a fair and equitable outcome. Ultimately, thorough financial planning can empower you to move forward and build a stable and prosperous life after divorce.

| Key Point | Brief Description |

|---|---|

| 💰 Asset Assessment | Evaluate all assets for equitable division. |

| ⚖️ Legal Guidance | Seek legal counsel for fair representation. |

| 📈 Future Planning | Create a budget and plan for financial independence. |

| 👪 Child Support | Ensure child support adequately meets children’s needs. |

Frequently Asked Questions

▼

You’ll need tax returns, bank and investment statements, loan documents, and any records of significant assets or debts. These documents provide a clear financial overview, which is necessary to ensure a fair settlement.

▼

Alimony depends on the length of the marriage, each spouse’s earning potential, the standard of living during the marriage, and contributions to the marriage. These factors help determine the alimony amount and duration.

▼

Equitable distribution means assets are divided fairly, but not always equally. Courts consider factors like each spouse’s contribution to the marriage when dividing property to ensure an equitable outcome.

▼

Create a post-divorce budget, manage your investments wisely, diversify your assets, and plan for retirement. Consult with a financial advisor for personalized guidance to maintain long-term financial stability.

▼

Child support is typically calculated based on both parents’ income, the number of children, custody arrangements, and additional expenses like healthcare and education. States have guidelines to ensure fair child support orders.

Conclusion

Navigating financial planning during divorce can be complex, but with the right information and support, you can achieve financial security and independence. By understanding your assets, planning for alimony and child support, and creating a solid post-divorce financial plan, you can confidently step into your future.